What Drives Portfolio Risk?

Portfolio risk is not just about how risky individual stocks are. It depends on how your holdings behave together. Understanding these drivers helps investors avoid false diversification and build portfolios aligned with their risk tolerance.

1. Volatility of Individual Holdings

Volatility measures how much a stock's price fluctuates. High-volatility stocks increase portfolio risk, but low-volatility stocks alone do not guarantee a low-risk portfolio.

- Growth stocks tend to be more volatile

- Defensive stocks tend to fluctuate less

- Volatility is only one input — not the full picture

2. Correlation Between Assets

Correlation describes how assets move relative to each other. If your stocks move up and down together, your portfolio risk remains high even if you own many positions.

- Highly correlated stocks amplify risk

- Low or negative correlation reduces overall volatility

- Many tech stocks are strongly correlated during market stress

This is why diversification doesn't always reduce risk — when stocks move together, you're not getting the diversification benefit you might expect.

3. Diversification (And Its Limits)

Diversification only works when assets are meaningfully different. Owning 10 stocks in the same sector or theme is often no safer than owning just one.

True diversification spreads risk across:

- Sectors

- Business models

- Geographies

- Asset types (stocks, ETFs, bonds)

4. Concentration Risk

Concentration occurs when too much of your portfolio is allocated to a single stock, sector, or theme. This is one of the most common hidden risk sources.

- Overweight positions increase downside risk

- Sector concentration magnifies drawdowns

- ETFs can also introduce hidden concentration

Understanding how risky your portfolio is requires analyzing concentration, not just the number of holdings.

5. Portfolio-Level Behavior

Portfolio risk emerges from the interaction of all holdings. Even low-risk stocks can combine into a high-risk portfolio if correlations and weights are ignored.

This is why portfolio-level analysis is essential — risk cannot be understood by analyzing stocks in isolation.

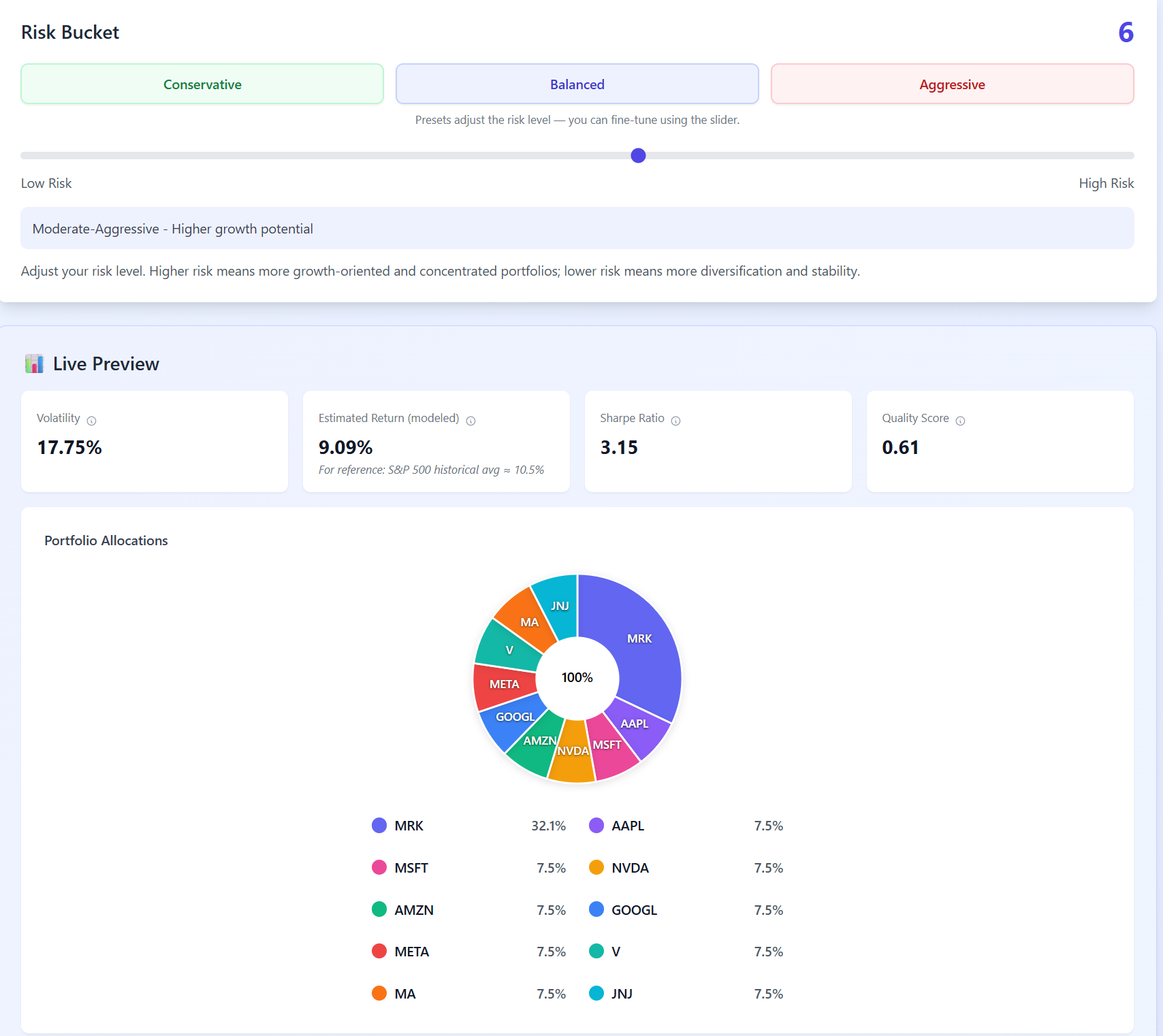

Live portfolio preview

Adjusting your risk level reshapes the entire portfolio — from allocations and concentration to volatility and expected return.

What Drives Portfolio Risk — At a Glance

Analyze Your Portfolio Risk

See how volatility, correlation, and concentration combine in your own portfolio.

Use the Portfolio Risk Calculator →