Portfolio Risk Calculator – See How Risky Your Portfolio Really Is

Understanding portfolio risk is essential for any investor, but it's not as simple as looking at individual stock risk. Your portfolio risk calculator reveals how your entire portfolio behaves together—considering volatility, diversification, and concentration. Many investors assume that holding multiple stocks automatically means low risk, but that's not always true. This portfolio risk calculator analyzes your holdings to show you how risky your portfolio really is, taking into account how your stocks move together, not just individually. Whether you're wondering "how risky is my portfolio" or need to calculate portfolio risk for planning purposes, this tool provides clear insights into your investment risk profile.

Want to understand what drives portfolio risk? Read the guide →

Calculate Your Portfolio Risk

Enter your stock and ETF tickers with their portfolio weights to see your risk score.

Use Portfolio Risk CalculatorWhat drives portfolio risk?

Portfolio risk is about how holdings behave together — not just how risky each holding is on its own.

What Is Portfolio Risk?

Portfolio risk is the overall uncertainty and potential for loss across your entire investment portfolio. Unlike individual stock risk, which measures how volatile a single stock is, portfolio risk considers how all your investments work together. When stocks move in similar patterns—what's called correlation—your portfolio risk can be higher than you think, even if you own many different stocks.

Diversification helps reduce portfolio risk, but only when your investments don't all move together. For example, owning 20 technology stocks might seem diversified, but if they all rise and fall together, your portfolio risk is still high. True diversification means holding investments that respond differently to market conditions, which can lower your overall portfolio risk.

Concentration risk is another key factor. If a single stock or sector makes up too much of your portfolio, that position can dominate your portfolio risk regardless of how many other stocks you own. A portfolio risk calculator helps you see these relationships clearly, showing you where your real risk comes from.

How This Portfolio Risk Calculator Works

Inputs

- Stock and ETF tickers

- Portfolio weights or allocations

What We Analyze

- Historical volatility

- Correlation between assets

- Concentration risk

- Risk-adjusted contribution of each asset

Your Final Risk Score

The calculator outputs a normalized risk score mapped to intuitive risk levels from 1 to 10. This score reflects how your portfolio has behaved historically, considering all the factors above. It's important to remember that this score describes portfolio behavior based on past data, not a prediction of future performance. Use it to understand your portfolio's risk characteristics and make more informed allocation decisions.

Portfolio Risk vs Individual Stock Risk

One of the biggest misconceptions about investing is that a single risky stock defines your entire portfolio risk. In reality, portfolio risk depends on how much of your portfolio that stock represents and how it interacts with your other holdings. A small position in a volatile stock might have minimal impact on your overall portfolio risk, while an overweight position in a seemingly safe stock could actually increase your portfolio risk if it's highly correlated with your other investments.

ETFs can either reduce or amplify portfolio risk depending on their composition. A broad market ETF might lower your portfolio risk by providing instant diversification, but a sector-specific ETF could increase concentration risk if you already hold individual stocks in that sector. The portfolio risk calculator accounts for these relationships, showing you the true risk profile of your combined holdings.

For example, imagine you own Apple stock at 30% of your portfolio and an S&P 500 ETF at 40%. While the ETF itself might seem low-risk, if it already contains significant Apple exposure, your effective Apple concentration is much higher than 30%. The portfolio risk calculator reveals these hidden concentrations and correlations, giving you a complete picture of your actual risk exposure.

Understanding Your Portfolio Risk Score

| Risk Score | Risk Level | Description |

|---|---|---|

| 1-2 | Very Conservative | Minimal volatility, high diversification, defensive holdings |

| 3-4 | Conservative | Low to moderate volatility, well-diversified, stable returns |

| 5-6 | Balanced | Moderate volatility, mix of growth and stability, market-like risk |

| 7-8 | Growth | Higher volatility, growth-oriented, some concentration |

| 9-10 | Aggressive | High volatility, concentrated positions, maximum growth potential |

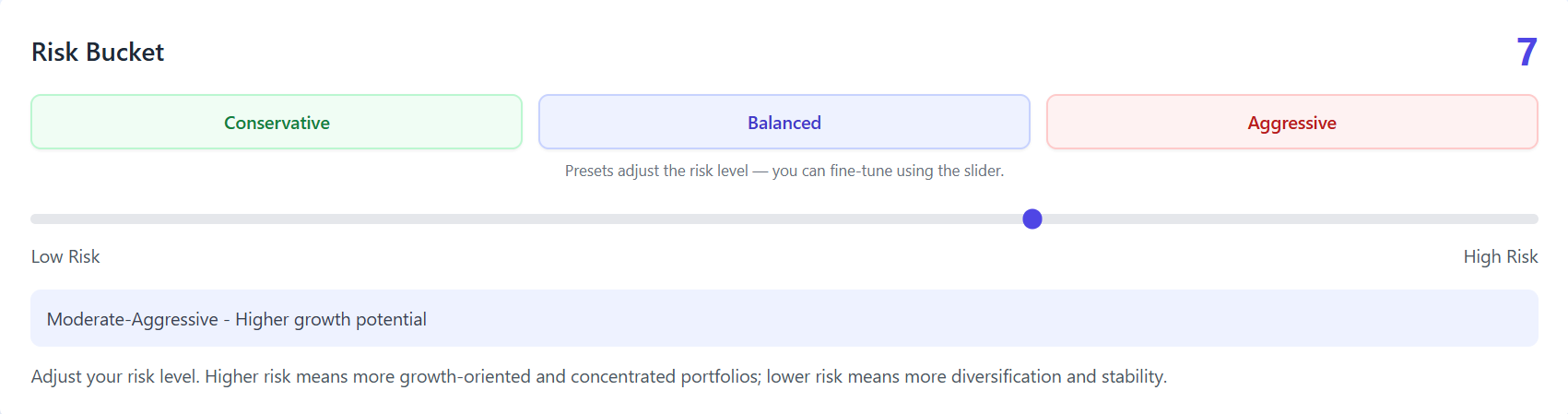

The risk selector interface allows you to choose preset risk levels (Conservative, Balanced, Aggressive) or fine-tune your risk preference using the slider. The calculator uses this risk level to analyze your portfolio and provide a matching risk score.

This risk score reflects your portfolio's historical behavior and risk characteristics, not your personal risk tolerance. Your personal risk tolerance is about how much volatility you're comfortable with emotionally and financially. The portfolio risk score shows you what your current portfolio actually delivers in terms of risk, which you can then compare to your personal preferences to see if adjustments are needed.

Who Should Use a Portfolio Risk Calculator?

- Long-term investors who want to understand their portfolio's risk profile

- ETF investors who need to see how their funds interact with individual stock holdings

- Retirement planners assessing whether their portfolio risk matches their time horizon

- DIY portfolio builders who want to verify their diversification is working

- Anyone unsure how risky their portfolio is and needs objective analysis

Common Portfolio Risk Mistakes

- Confusing number of holdings with diversification—owning many stocks in the same sector doesn't reduce risk

- Overweighting a single stock or sector without realizing the concentration risk

- Assuming ETFs are always low risk, ignoring sector overlap and correlation with existing holdings

- Ignoring correlations between assets, missing how stocks move together

- Focusing only on returns without considering the risk taken to achieve those returns

What to Do After Measuring Your Portfolio Risk

- Adjust allocations to match your risk preference—reduce positions that push your risk too high or too low

- Reduce concentration by limiting single-stock and sector weights to acceptable levels

- Compare your portfolio risk to benchmarks like the S&P 500 to see if you're taking more or less risk than the market

- Rebalance based on risk contribution, focusing on positions that drive the most portfolio risk

If your portfolio risk is higher than your comfort level, consider exploring our conservative portfolio allocation guide. For help optimizing your holdings, try our stock portfolio optimizer to build a portfolio that matches your risk preferences.

This portfolio risk calculator is designed to help you understand your portfolio's risk characteristics based on historical data. It's a tool for education and analysis, not a prediction of future returns or a guarantee of performance. Past behavior doesn't guarantee future results, but understanding how your portfolio has behaved can inform better decision-making. Use this information alongside your personal risk tolerance, investment goals, and time horizon to make informed choices about your portfolio allocation.