StockRisker — Portfolio Risk Calculator & Optimizer for Stocks & ETFs

StockRisker helps you calculate portfolio risk and optimize stock and ETF portfolios based on your chosen risk level. Understand diversification, volatility, and tailored allocations with our intuitive platform.

- Evaluate portfolio risk and diversification

- Optimize allocations based on your chosen risk level

- Analyze volatility, Sharpe ratio, and quality score

- Compare alternative allocations easily

Start by using our Portfolio Optimizer below to build your allocation.

Get StartedRuns entirely in your browser • No data stored

Risk-Based Optimization

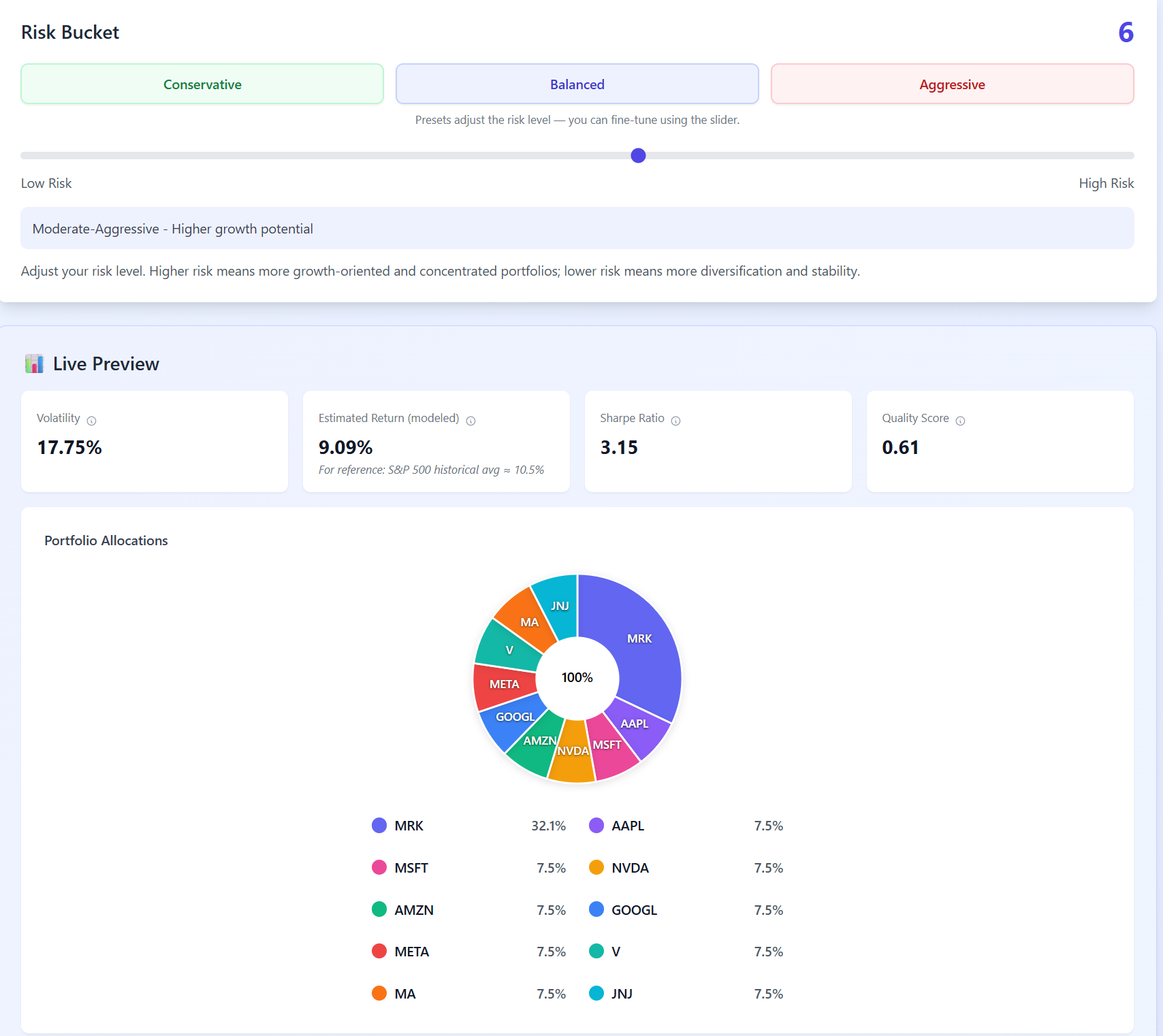

Select your risk level from 1 to 10. The optimizer builds portfolios that match your risk tolerance while maintaining diversification.

Real-Time Portfolio Metrics

Expected return, volatility, quality score, and Sharpe ratio update instantly as you adjust risk or weights.

Interactive Weight Adjustment

Adjust allocations manually and see portfolio metrics update instantly. The system automatically rebalances remaining positions.

Multiple Stock Universes

Choose from predefined stock universes or build custom portfolios from available tickers.

Shareable Results

Export portfolios and share via URL. Portfolio configurations are encoded in the link for easy collaboration.

No Account Required

Start building portfolios immediately. All optimization runs in your browser with no data stored on servers.

How StockRisker Works

StockRisker evaluates portfolio risk and performs portfolio optimization by analyzing historical volatility and correlations between your holdings. The system builds risk-based portfolios that balance expected return with volatility, ensuring appropriate diversification across sectors and assets. This approach helps you understand how your investments interact together and optimize portfolio allocation to match your risk tolerance.

Why Understanding Portfolio Risk Matters

Understanding portfolio risk helps investors build more stable and effective allocations. Measuring risk reveals how your investments behave together, highlighting concentration and correlation issues that individual stock analysis misses. This knowledge supports better diversification decisions, helping you create portfolios that match your risk tolerance and long-term goals while maintaining stability through market volatility.

Built for different needs

For Individual Investors

Build and optimize stock portfolios based on your risk preference. Understand how different allocations affect portfolio metrics.

For Financial Advisors

Create portfolio proposals for clients. Share optimized allocations via URL and demonstrate different risk-adjusted scenarios.

For Developers

Integrate portfolio optimization into your applications. All processing runs client-side with no backend dependencies.

Key features

Risk Scoring

10-level risk system from conservative to aggressive

Live Metrics

Real-time calculation of portfolio statistics

Auto Rebalancing

Automatic weight adjustment maintains valid constraints

Privacy First

All processing runs locally in your browser

This tool is designed to help you explore and understand risk-aware portfolio construction. It is for informational purposes and does not constitute financial advice.